Donors

Leave a Legacy Gift

Make A Lasting Impact

A planned gift to The Community Foundation is a simple yet significant way for you to make a lasting impact after your death. Once you have provided for your loved ones, we can help you structure a planned gift that will satisfy both your philanthropic and tax goals. Let us help you integrate charitable giving with your estate plan.

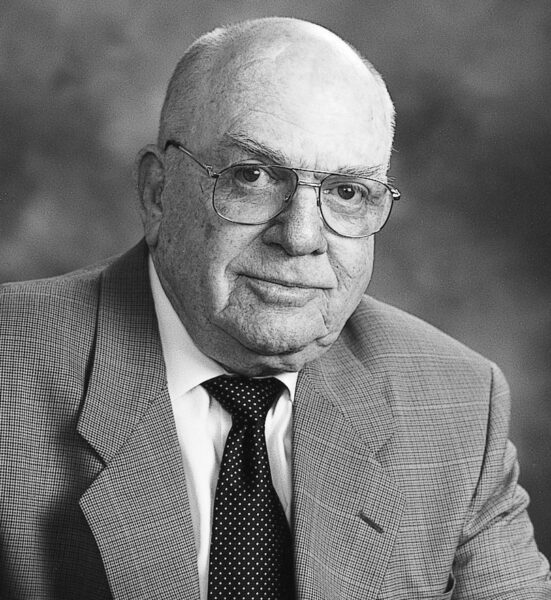

Donor Profile: Frank V. Oliver, Jr.

Frank V. Oliver, Jr.’s bequest has benefitted Putnam County with dozens of grants providing a range of assistance, from creative and efficient services to veterans, to students striving for a better education, to residents who are food insecure.

Continued Impact on the Future

You can have a continued impact on the future when you make a gift as part of your overall financial or estate plan. Some can be structured to provide life income for you or your family; others only become effective upon your death. But each one helps make life in Northeast Florida better for all.

Benefits of a planned gift include:

- Avoiding capital gains tax on appreciated value

- Creating income for life

- Reducing estate taxes

- Carrying out your charitable intent

- Preserving your assets in perpetuity

- Creating a permanent legacy

Here are some planned giving strategies to consider.

Bequest by Will

When you include The Community Foundation in your will, we will establish a special legacy fund in your name. In doing so you leave a permanent bequest to your community, while enjoying the assets you need to maintain your current lifestyle. Plus, you are able to distribute some or all of your assets, tax free.

You can give cash, appreciated stocks, or other assets. Some of the most tax-efficient asset types to give through your will come from retirement plan accounts, since heirs would be taxed on the income in respect of the descendent (IRD). You can choose to give a stated dollar amount, a specific property, a percentage of your estate, the remainder after distributions to other beneficiaries, or you can make your gift contingent on certain events. You can decide to do it at any age by adding to an existing will or drafting a new one. Contact John Zell, SVP of Development, to learn more.

Charitable Gift Annuity

A Charitable Gift Annuity provides guaranteed income for life, the benefit of an immediate income tax deduction, and a legacy that supports the causes that are important to you forever.

You may establish your Charitable Gift Annuity with cash or securities if you are least 65 years old. If you donate appreciated securities, you will avoid the tax on capital gains. We will set up a contract with you that combines immediate annuity payments with a deferred charitable gift. You receive a stream of income that is fixed, regardless of market conditions. Upon your death, we set up a charitable fund on your behalf.

You can use your Charitable Gift Annuity income to supplement your own lifestyle, or that of someone else: a sibling, a dependent parent, a friend, or a former employee. Annuity payments can begin immediately or be deferred to increase your charitable income tax deduction. A portion of the income may be a tax-free return of principal, while some is taxed as ordinary income or capital gains. The amount of annuity paid and the tax deduction received depends on the age of the recipient and the current annuity rate (as established by the American Council of Gift Annuities). Minimum to establish a Charitable Gift Annuity: $25,000.

Charitable Remainder Trust

A charitable remainder trust allows you to receive income for the rest of your life, knowing whatever remains will benefit your community. You transfer assets into a trust, and the trust pays you or a beneficiary regular income payments. Upon the beneficiary’s death or after a defined period of years, the remaining assets in the trust transfer to The Community Foundation. You may choose to receive a fixed income or one that changes with market conditions. You can start receiving annuity payments immediately or defer them to increase your charitable income tax deduction.

A portion of the income may be a tax-free return of principal, while some is taxed as ordinary income or capital gains. The amount paid and the tax deduction received depends on the age of the recipient and the current annuity rate (as established by the Internal Revenue Service).

You can pick one of these options for your Charitable Remainder Trust:

- Annuity trust pays you a fixed dollar amount.

- Standard unitrust pays you an amount equal to a fixed percentage of the net fair market of the trust and is recalculated annually.

- Net income unitrust pays you the lesser of the fixed percentage specified by the trust agreement or actual trust income; some net income unitrusts allow you to make up deficiencies in past years.

- Flip unitrust is a net income unitrust that converts to a standard unitrust upon a triggering event, such as the sale of an asset used to fund the trust.

Charitable Remainder Trust

A Charitable Lead Trust lets you make significant charitable gifts now while transferring substantial assets to beneficiaries later.

You transfer assets into a trust, which pays The Community Foundation an annual amount to build a charitable fund. During its term, the trust can be managed expertly by experienced professionals, which may help your trust investments grow over time. When the trust terminates, either upon your death or after a specified number of years, its final assets are transferred to those you designate; any growth in the trust passes to recipients, often with significant transfer-tax savings.

A Charitable Lead Trust shelters investment earnings from tax, and it offers gift, estate, and generation-skipping tax benefits. For example, trust assets are removed from your estate for estate tax purposes. You may also capture future gift tax deductions. However, at the time your trust is established, you may owe gift tax on the present value of your gift to the final beneficiary.

You have several options when establishing your trust. You can create a Charitable Lead Trust during your life or through your will. The trust contributes to charity through your community foundation – either for a number of years or for your lifetime. And, you select one of two types of Charitable Lead Trusts. A Charitable Lead Unitrust makes annual distributions of a fixed percentage of the trust assets to the charitable fund you establish. If you create a Charitable Lead Annuity Trust, the charitable fund you establish will receive a fixed dollar amount each year.

Life Insurance Opportunities

A gift of life insurance is a simple way to make a significant contribution to your community and establish your legacy of giving. You can make a gift when life insurance is no longer needed for personal financial wealth replacement. You may receive a number of tax benefits, including reduced income taxes and estate taxes. And, if you choose to continue paying premiums through The Community Foundation, you will be entitled to a charitable contribution of up to 50 percent of your adjusted gross income.

You can replace the dollar value of an asset transferred to your community foundation with a life insurance policy. Or you can use regular payments from a Charitable Gift Annuity or Charitable Remainder Trust to establish an irrevocable life insurance trust. The trust can purchase insurance on your life to benefit your heirs. This way, you can make a gift to The Community Foundation and replace the value of this gift within your estate with life insurance proceeds.

Charitable Remainder Trust

Retirement plan assets are some of the most tax-efficient assets to transfer to charity upon your death.

Deferred income tax and estate taxes can erode the value of retirement assets; in some cases, the combination of taxes can reach as high as 80 percent, leaving very little for your heirs. By leaving retirement assets to your Community Foundation fund, you can preserve 100% of your hard-earned assets for the good of the community – forever.

Want to know more about contributing assets to The Community Foundation?

Here to Help

For more information, contact:

Please Note: The purpose of this website is to provide general gift, estate, and financial planning information. The Community Foundation for Northeast Florida is not engaged in providing legal or tax counsel. For advice or assistance in specific cases or whether to make certain a contemplated gift fits well into your overall circumstances and planning, the services of an attorney or other professional advisor should be obtained.